By the SMU Social Media Team

Mention “forensic” and one would naturally think of crime scene investigators armed with fingerprint powders and DNA test kits—not accounting professionals wielding calculators and spreadsheets.

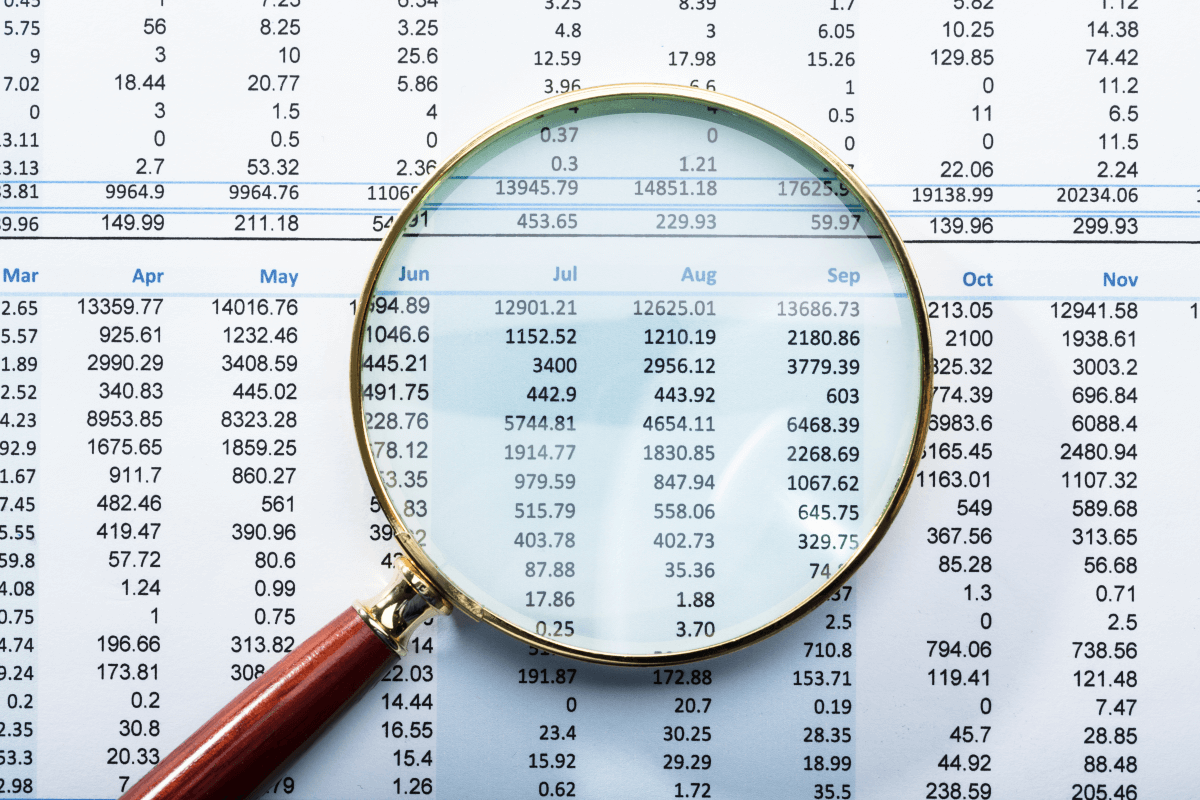

However, global financial hubs like Singapore are witnessing a growing need for financial forensic professionals as the complexity and volume of white-collar frauds are on the rise—with 42 per cent of Singapore companies experiencing fraud in the past 24 months, and cumulative losses of up to US$50m reported by almost a quarter of respondents surveyed by PwC.

Dr Seow Poh Sun, Assoc Prof of Accounting (Education) and Associate Dean (Teaching and Curriculum), SMU SoA

“The list of white-collar crimes is growing and becoming more complex, and they include activities such as forgery, bribery, corruption, money laundering, terrorism financing, financial statement fraud, and cybercrimes,” notes Dr Seow Poh Sun, Associate Professor of Accounting (Education) and Associate Dean (Teaching and Curriculum) at the SMU School of Accountancy (SoA).

“Global financial hubs such as Singapore and Hong Kong are routing posts that inevitably risk money washing through. Banks and financial institutions in Singapore have increased their capacity to recruit staff to work in the area of financial crime as they ramp up their capability to improve crime detection.”

In a nutshell, forensic accountants are crime fighters with a different set of tools — they leverage their auditing abilities with investigative skills to determine the causes of suspicious financial activity. Such information may serve as credible evidence during criminal trials or to enable the recovery of losses from frauds.

With the acceleration of digitalisation in financial sectors resulting in cyber fraud on the uptick, there lies a need for digital forensics expertise in finance. As such, the SMU SoA has launched a new second major in Financial Forensics, to equip students with advanced accounting knowledge, in-depth understanding of the audit process, as well as cultivate the discerning mindset required to effectively prevent and detect fraud.

Financial forensics for future-ready grads

As Dr Seow notes, the SMU School of Accountancy has been working hard to develop industry-relevant and innovative academic programmes and curriculum.

“We work closely with industry partners to understand emerging trends,” adds Dr Seow.

“In 2018, we launched the Accounting Data and Analytics Second Major, which is a first in Singapore. After that, we identified financial forensics as another fast-growing emerging area within the accounting profession.”

During the development stage, the School engaged 38 industry stakeholders—employers of SMU graduates—and professionals including SoA alumni from the Big Four accounting firms, consulting firms, corporations, major banks and regulatory agencies. The industry partners were supportive of the initiative and even offered internship placements.

Furthermore, SkillsFuture Singapore (SSG), a national movement to provide Singaporeans with the opportunities to develop their fullest potential throughout life, updated the Skills Framework for Accountancy, a career map showing the various pathways for accounting professionals, and Financial Forensics was included as a new track. Other industry initiatives related to financial forensics have also emerged in recent years, such as The Institute of Singapore Chartered Accountants (ISCA), which launched a Financial Forensic Accounting Qualification (FFAQ).

Specifically, students pursuing the new Financial Forensics second major will be familiarised with the thought process on how to go about conducting a financial investigation, and the types of investigative tools required for each unique situation.

An investigation typically involves a fraud allegation that has been received by a company, in which the forensic investigator would need to consider the impact of the investigation on relevant stakeholders, followed by the design and deployment of investigative tools—which includes data analysis, digital forensics, reviewing of financial books and records, conducting interviews with personnel within or outside of the company, and business intelligence.

A timely specialisation in a new normal

A financial forensics specialisation can also better prepare graduates in a post-Covid-19 world, as the pandemic saw a rise in fraud during a time of economic and business uncertainty. Businesses and organisations are also experiencing the need to build credibility in a rocky economic climate, and can tap upon accounting professionals with higher skill sets in forensics investigation and risk assurance to bolster their ethical framework and protect financial security and safety in a digitalised world.

For starters, accountants working in the financial forensic area would require:

- solid accounting technical knowledge and financial analysis skills to distill essential information;

- analytics capability to interpret large data sets as tech savvy criminals use technology to cover up their fraudulent activities; and

- fundamental knowledge of the legal system to determine whether a financial crime has occurred and to gather legally usable evidence.

SMU SoA has designed the Financial Forensics Second Major to cover the three main knowledge domains: a) advanced accounting technical competency, b) technology and analytics capability, and c) fundamental legal understanding in related areas. Students are required to complete five compulsory courses and three elective courses. The five compulsory courses include:

- Two courses under the accounting domain: Forensic Accounting and Investigation; Internal Audit

- Two courses under the technology domain: Business Data Management; Forecasting and Forensics Analytics

- One course under the legal domain: Financial Crime

Honing a transferable skill

While financial forensics may seem to be a very specific niche in the field of accounting, having a “forensic mindset” is, according to Dr Seow, “to be curious, asking the right questions and not taking information at face value—all important qualities required in many roles within the accounting profession”.

He adds: “There are also many soft skills that are transferable and graduates with such skills will do well in other areas.”

For example, forensic accountants are detail-oriented and inquisitive to raising questions and problem solving. Such professionals often gather evidence by interviewing people, and therefore possess good listening skills and interview skills to draw out necessary information. In addition to interviewing, good communication skills are essential to communicate their findings and conclusion both in written and oral forms.

Professionals with financial forensics knowledge can be employed in diverse areas, such as:

- internal audit and specialised audits;

- financial crime detection and prevention;

- bankruptcy, insolvency, and business restructuring;

- consulting in risk management;

- preventing and resolving commercial disputes;

- conducting business / corporate intelligence checks;

- the due diligence process of mergers and acquisitions;

- tax investigations and economic crime investigations; and

- developing and implementing policies and controls for compliance.

In addition to employment in public accounting firms, financial institutions, law firms and corporations, other career pathways include investigation and litigation support at regulatory agencies such as the Singapore Police Force’s Commercial Affairs Department, the Monetary Authority of Singapore, the Inland Revenue Authority of Singapore, and the Corrupt Practices Investigation Bureau.

With increased scrutiny on how corporate organisations are governed, along with the major shifts brought on by a digital economy, it is easy to see why demand for financial forensics specialists is undergoing such robust growth. Beyond financial investigations, such professionals also hold the responsibility of leading the way in solving increasingly complex accounting issues, and upholding the integrity of the industry at large.

Be accountable for your future. Find out more about the SMU Bachelor of Accountancy programme today.