Impact Investing and ESG – An Amalgamation in the SMU Sustainable Investment Club

As President of the Sustainable Investment Club at SMU, Ong Ken Jin has integrated ESG analysis into the club’s curriculum to clarify misconceptions about impact investing. Ken Jin’s interest in ESG aligns with accounting's role in data interpretation and stewardship, and he advises future enthusiasts to stay curious, adaptable, and open to new perspectives in the evolving field of ESG and impact investing.

As a student at the SMU School of Accountancy, I’ve always held a keen interest in Environmental, Social and Governance (ESG) issues. As the President of SMU Sustainable Investment Club, a CCA at SMU that educates students on sustainable and impact investing, I’ve found a way to assimilate ESG analysis into the Club’s curriculum. Not many people understand how Impact Investing and ESG work; here is my attempt to break down the concepts for you.

What is impact investing, and an introduction to SMU Impact Investing

By definition, impact investing is investing with the intention to generate positive, measurable social and environmental impact alongside a financial return.

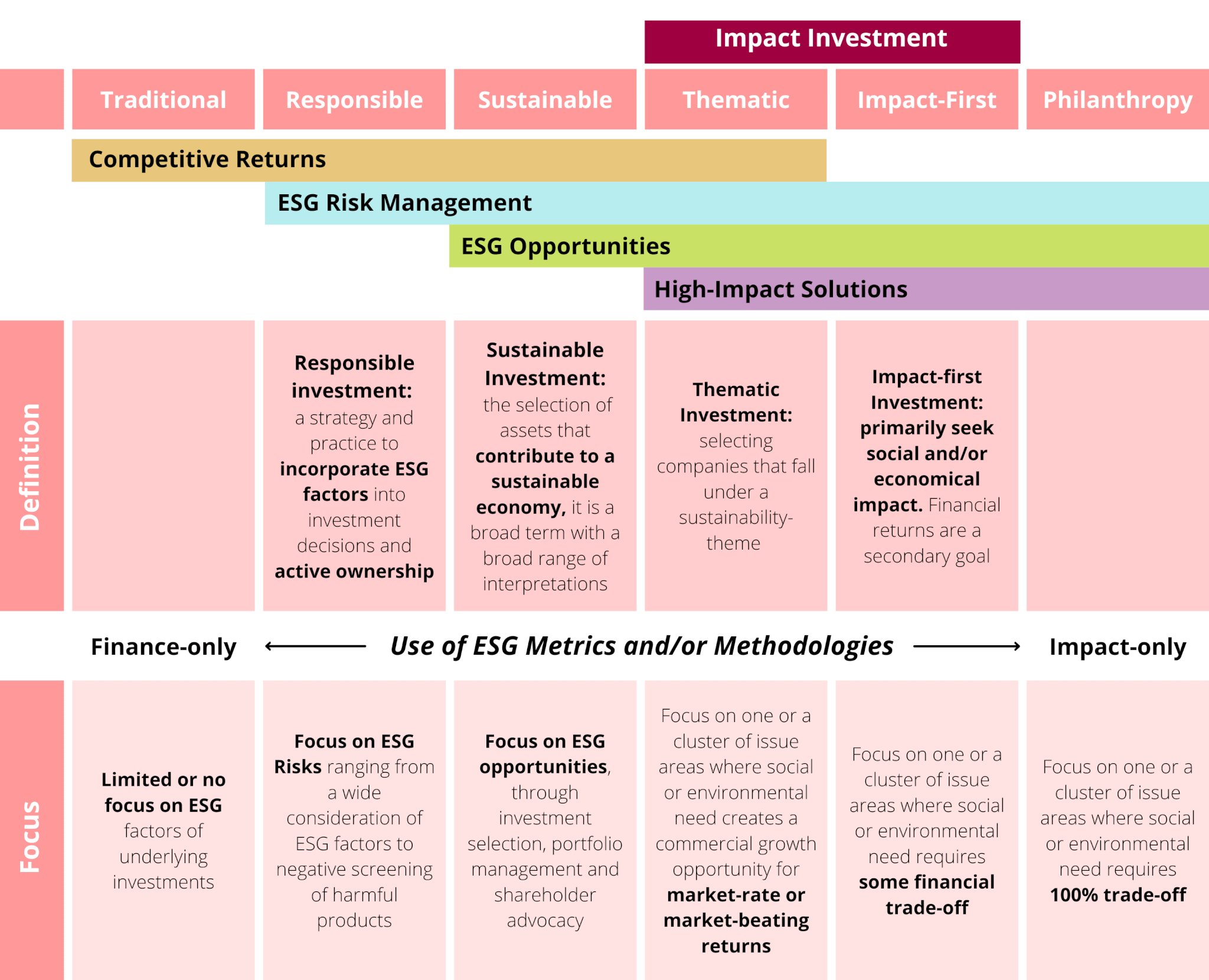

With the many misconceptions that exist within sustainable finance, it is crucial to differentiate various terms to decipher what the industry calls the ‘alphabet soup’. Unsurprisingly, impact investing is commonly misunderstood by many.

Here is a high-level overview of the spectrum of investments (non-exhaustive):

SMU Sustainable Investment Club is the first and currently, only student club in Singapore to have an exclusive focus on impact investing and more broadly speaking, sustainable finance. As an academic club, it was also one of the avenues I had first turned to, to build up my knowledge in impact investing.

Today, I am fortunate to lead the Club alongside my Executive Committee (Exco) as we broaden the Club’s scope to include financial valuation as well as ESG factors. Through a one-year commitment, Analysts would undergo a series of masterclasses, internal case competitions and networking sessions, with the aim of building a community of like-minded individuals who are passionate in leveraging capital to bring about systemic change.

Journeying towards understanding ESG

My interest in ESG was sparked by a myriad of reasons ranging from the relevance it draws from my academic studies to my personal interest in sustainability.

Personally, accounting to me facilitates the measurement and communication of financial and non-financial information. The foundation of ESG closely resembles this as it supports the improvement in economic decision-making for users like that of financial reporting.

Moreover, another role that accounting plays is the role of stewardship and this creates another area of overlap on the topic of engagement. Through engagement, investors are better able to identify material ESG issues, set expectations for the adoption of best practices, track performances and many more. Together, these factors sparked my interests in the field.

With my personal interests in sustainability, my interest in ESG also helps to build a greater purpose into my career journey. The ever-changing space made it particularly intriguing for me to learn and understand the challenges that come with it.

Unsurprisingly, one of the biggest challenges in ESG is interpreting data. Regardless of fields, data-driven insights are key to sustaining competitive advantages. This is particularly the case for ESG given the financial materiality it carries both for corporates and investors. Hence, it always comes in handy to have skillsets in data analytical tools.

Differentiating ESG and Impact Investing

Diving into ESG, it is first necessary to set it apart from impact investing. ESG is essentially an approach which provides a non-exhaustive set of non-financial factors that could serve to identify opportunities and mitigate risks for a company. ESG to me serves as a holistic form of evaluation for investments and further identifies potential areas that could prove detrimental to a firm’s performance. The growing emphasis placed on ESG creates a further avenue in shaping how consumers and investors view a business. As such, the incorporation of ESG considerations into the investment process or into a business model would only prove to be beneficial for the business.

Impact investing, as defined earlier, differs in the sense that it is by nature a form of investment strategy and it may or may not use ESG metrics. Within impact investing itself, it could be further subdivided into various categories.

Unfortunately, owing to the lack of standardisation, there is currently a wide array of approaches and definitions within the field of sustainable finance.

A word of advice to budding ESG and impact investment enthusiasts

Particularly in Asia, where the world of sustainable finance is still nascent, it is important for its people to remain intellectually curious. As regulations develop and standards align, there will be constant changes to sustainable finance practices that will require individuals to remain adaptable.

While ESG and impact investing are some of the hottest topics today, one should remain intentional when pursuing an interest within the space. The urgency to adopt best practices such as conducting ESG analysis should not outweigh the importance of doing things right, especially with the many controversies seen today.

My advice to juniors who are interested in pursuing their interest in ESG and impact investing would be to remain open to different perspectives, to always remain curious and to never be afraid to ask questions. There is no ‘one size fits all’ solution when it comes to ESG or impact investing, even within the same industry.

Being open to new perspectives would help to develop your own views and remove your subconscious biases. The constant changes in this ESG and Impact investing space give voracious learners an edge, but it is essential to be adaptable and updated on the latest developments. Everyone needs to start somewhere when pursuing their interests, so never be afraid to ask questions.

Learn more about the SMU Sustainable Investment Club and what it does here.