Accounting Professionals in the Fight Against Rising Financial Crime

Accounting professionals are key in fighting global financial crime by enforcing internal controls, auditing, and ensuring regulatory compliance. Their skills help identify suspicious activities, analyse anomalies, and uphold financial integrity. Continuous education and tech updates are vital for their role in combating financial crime.

The global wave of digitalisation has accelerated at a remarkable rate over the past two years. However, as organisations incorporate digital technologies in their business operations, they are exposed to new vulnerabilities and a greater risk of financial crime. Increasingly, accounting professionals are expected to play a larger role in supporting their organisations in their risk and compliance functions.

To find out more about this growing demand for accounting professionals with knowledge in financial forensics, we speak with Charles Li, Director, Tax & Private Client Services, Drew & Napier LLC and an adjunct faculty at SMU, as well as Angel Peh, a SMU School of Accountancy (SOA) graduate.

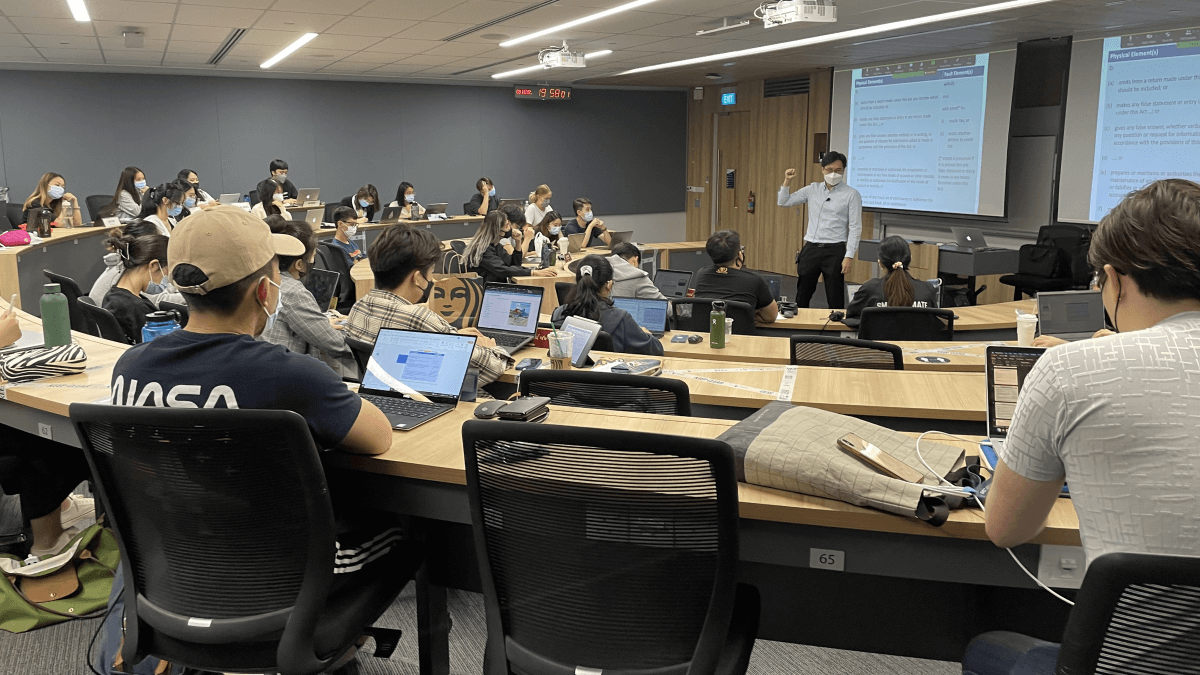

Charles teaches the course Financial Crime, a module offered under the Second Major in Financial Forensics in SOA. He is also a graduate of the SMU Bachelor of Accountancy (SOA) and the Juris Doctor postgraduate (SMU Yong Pung How School of Law) programmes.

As one of Charles’ students at SOA, Angel pursued a Bachelor of Accountancy and a Second Major in Financial Forensics. As of publication, she has successfully completed an internship with the Commercial Affairs Department of the Singapore Police Force (SPF) where she was involved in its scam prevention and outreach efforts.

Hi Charles, following your graduation from the SMU Bachelor of Accountancy and SMU Juris Doctor programmes, you have led a successful career in the tax and legal profession. What motivated you to come back to teaching at SOA?

Charles: My current teaching appointment came about unexpectedly.

I was first asked to provide feedback on the subjects to be offered under the new Financial Forensics major back in 2019. I thought that it would be a very useful second major for Accountancy students and submitted my feedback on the proposed course outline for Financial Crime since I was able to draw from my past experiences as an auditor, prosecutor and defense lawyer.

One month later, I received an offer to teach the Financial Crime course as an adjunct lecturer. This came out of the blue as I had not taught at SMU since 2012 and it took me a while to accept the offer.

I was motivated to take up the appointment given my strong interest in the topic and in teaching. The proof is always in the pudding, so the course feedback given by my students is always a key motivation for me to continue teaching.

You wear many hats, as our former SOA student, a successful SOA alumnus and now adjunct faculty. Can you share with us your thoughts on the evolution of the accounting field and education?

C: When I applied to SOA around 2001, what struck me was how cutting-edge SOA’s broad-based pedagogy was. Today, the curriculum has evolved to meet market requirements. It may be tough for lecturers to constantly update their curriculum all the time, but SMU ensures it is done so that what we teach remains contemporary and relevant.

Would you agree that knowledge in financial forensics is important for the accounting profession today, and why?

C: Yes, financial crime has been on the rise in terms of numbers, value and complexity. Financial forensic skills are needed not just by law enforcement agencies and professional services firms, but also by large businesses in their risk and compliance functions. Businesses are facing heavier legal and ethical obligations to avoid being complicit in facilitating crimes such as corruption and money laundering. The profession certainly needs people who are skilled in financial forensics.

Financial Crime is a course offered under the Second Major in Financial Forensics that you are currently teaching. Can you share with us more about this course and why you would encourage students to take it up?

C: The purpose of this course is to expose students to key issues in domestic and international financial crimes. Students will gain a broad understanding of the different types of financial crime, the evidence needed to prove financial crime, and the domestic and international efforts to combat financial crime.

It is not a law course, but emphasis is placed on the legal definitions of the various types of white-collar offences. This is because the legal consequences of a wrongdoing depends very much on whether it is a crime or not, subject to what Parliament defines it to be.

It is also not a course on investigative methods and techniques because that is the subject of other courses in the Financial Forensics major.

It is a course about what financial crime is, why it happens, the harm it causes and what is being done to fight it. Are we winning or losing that battle? You can join the course to find out!

Angel, as a student who has completed the Financial Crime course, what are some of your takeaways from the programme?

Angel: My biggest takeaway from this course was learning how to apply the Penal Code to real life financial crime cases, which was very interesting to me. I found it rather intriguing how minor changes in the phrasings of the Penal Code sections could change the meaning of an offence entirely.

Towards the end of the course, we also learnt about money laundering and terrorism financing. I was surprised to learn how many types of financial crimes were linked to money laundering and terrorism financing, which was why it was difficult to apprehend many criminals, as the crime syndicates were often large and based overseas. It was fascinating to learn how people would go to such great lengths to launder money obtained through criminal means.

What was your internship at the SPF about, and how did the knowledge you gained from the course help in your work?

A: The Financial Crime course sparked my interest in Financial Forensics, which led to my internship with the Commercial Affairs Department of the SPF. Using knowledge picked up from Financial Crime – such as the types of financial crime and how they are linked to money laundering and terrorism financing – let me better appreciate the work done by the SPF. Linking the knowledge gained from the course to my role in scam prevention and outreach at SPF, I came to understand the difficulty of controlling the scam rate in Singapore, as the money scammed out of victims was often laundered through many different parties, making it very difficult to trace and catch the real masterminds behind the scams.

I am looking forward to further my understanding in this field in my upcoming internship with KPMG’s Forensic Investigation department.

Do you aspire to join the fight against financial crime? Find out more about the Bachelor of Accountancy here.