[Featured image: (L-R) Lim Ting Zhou, Lester Tay, Aaron Er, Grace Lim, Sruthi Bhaskar, Wilson Teo and Brandon Yap]

By the SMU Social Media team

Most graduates would prefer to focus on their career rather than fixing their finances when they complete their studies. But as more than ever are leaving university in debt, the importance of financial prudence has never been more apparent.

“How can we make Finance Literacy fun and lower its perceived accessibility to others?”

That thought was one of the main drivers inspiring SMU alumnus (class of 2016) Aaron Er Ziyang and third-year undergraduate Wilson Teo to join the Citi-SMU Financial Literacy Programme, and subsequently develop the ‘1 Million Dollar Journey’ mobile app together with a team comprising SMU faculty, Citi staff, Institute of Technical Education (ITE) lecturers and students, to teach Polytechnic and ITE students about financial literacy in a fun way.

While studying at SMU’s Lee Kong Chian School of Business, Aaron and Wilson were looking for skills-based volunteering opportunities. They chanced upon the “Train-the-Trainers” programme, which enables students to learn about financial literacy and give back to the community at the same time.

“The programme is designed for students – regardless of degree or major – who are interested in acquiring financial knowledge and promoting positive change at the same time. All participants go through a selection process so programme leaders can better understand their aspirations and personalities,” explains Aaron.

Aaron and Wilson are now financial literacy trainers and involved in the selection process of new trainers.

“We place a lot of emphasis on the selection process as our trainers will be cornerstones contributing and making our vision a reality,” notes Aaron.

Once selected, the trainers-to-be learn directly from SMU finance and communication experts, including SMU Adjunct Faculty Dr Larry Haverkamp, Lecturer of Finance Karen Gan, as well as Assistant Professor of Corporate Communication Sungjong Roh, from the SMU Lee Kong Chian School of Business.

“We also have industry experts who share other important aspects of financial planning like CPF (Central Provident Fund) and HDB (Housing Development Board),” says Wilson.

The programme’s central philosophy is teaching finance through fun and engaging games. And it was during one of those classroom games that Wilson and Aaron were inspired to develop the ‘1 Million Dollar Journey’ app, in the hope of reaching out to more students.

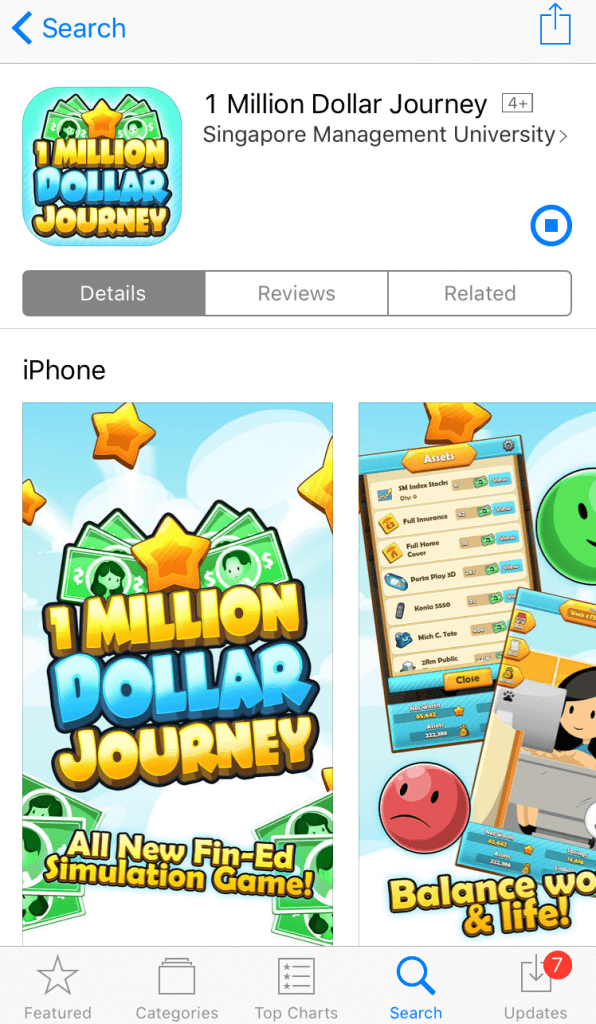

The app, which was officially launched in August 2016, teaches real-life financial concepts in a gaming format, exposing students to financial terms in a fun and engaging way. It’s designed for users with entry-level knowledge of financial literacy.

In the game, the player has the opportunity to become a virtual millionaire “through sound financial decisions like ‘invest more’ and ‘spend less on luxury goods’,” elaborates Wilson. “We aim to let the students explore these ideas in the game and hopefully they’ll transfer these sound ideas into their real life when they start having their first income,” he adds.

Making finances fun was not an easy game though.

“The key challenge to developing the mobile app game was finding the delicate balance between simplicity and complexity in our simulation of the real world,” recalls Aaron.

Screenshots of the ‘One Million Dollar Journey’ app

“We spent a copious amount of time to test prototypes and obtain feedback from our end users. We subsequently utilised the feedback – introducing volatility into the game, and a happiness index to better represent the dynamism of the real world,” he says, adding, “It was not an easy task creating an app that balances the education aspect while being enjoyable.”

Aaron and Wilson advise young students, who begin their studies at poly, ITE or university, to learn the importance of budgeting and tracking their expenditure.

“It’s not only about how much you earn, but also how you are able to manage your finances that grants you that financial freedom. A person earning $10,000 a month who spends $11,000 per month is never going to be financially independent,” says Wilson.

Interestingly, Aaron advises students graduating with debts to get used to the feeling of being in debt rather than making rash financial decisions to pay it back as soon as possible. He explains, “Being in debt is normal – many of us would probably go on to take up a HDB Loan or a Car Loan.”

“Being in debt is definitely not a nice feeling, but we need to get used to the reality of it; and to consider other factors instead of simply aiming to repay it in the shortest amount of time.”

He concludes on a note of prudence and caution, “It is important to carefully evaluate your repayment ability and plan it out. Don’t be too comfortable with debt either – there is a fine line between rationality and running from reality.”

This year’s 4th Citi-SMU Financial Literacy Symposium, entitled “Financial Education to Financial Empowerment” will explore the diverse avenues to empower youths in discovering and bolstering their existing base of financial literacy knowledge. Keen to find out more at the 21 Sep 2017 symposium? Register to attend at https://tinyurl.com/citismusymp17.