How SMU Accountancy Alumni Leveraged AI to Revolutionise Tax and Accounting with Startup Taxpedited

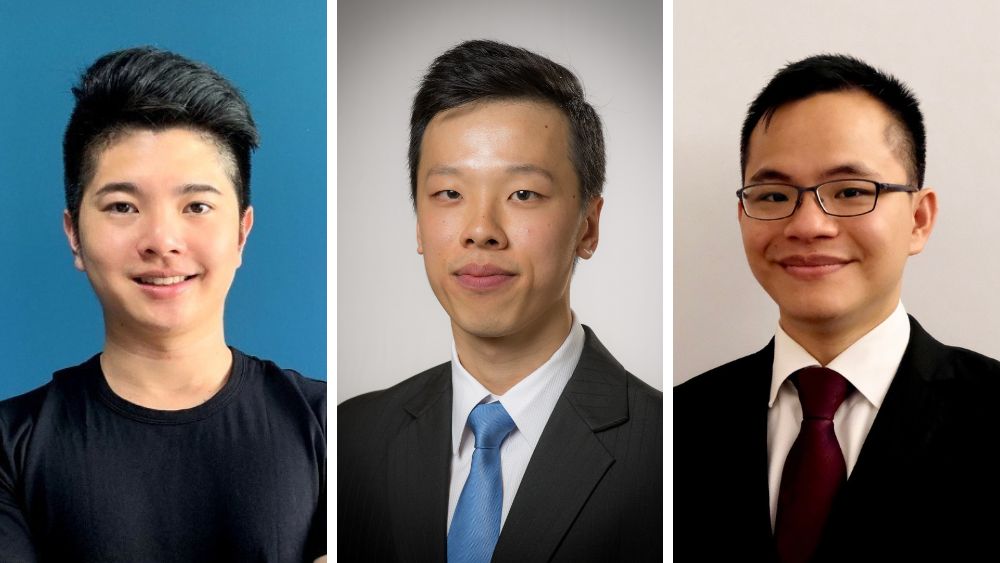

Taxpedited co-founders Russell Sim, Jon Goh, and Jeremy Seow first met as group mates in their final year at SMU. Their catch-up sessions years after graduation eventually led them to build a startup developing tax and accounting automation tools. The SMU Accountancy and Business graduates share more about the journey of building their startup, challenges, and how SMU has helped their entrepreneurial journey.

What if a project group mate could turn into your future business partner? For the founders of startup Taxpedited, this became a reality came after meeting as classmates at SMU.

Taxpedited develops advanced technology solutions for tax firms, tackling challenges such as inefficiency, rising labour costs, and the talent crunch. Its founders—SMU Accountancy graduates Russell Sim and Jon Goh, along with Business and Accountancy graduate Jeremy Seow—first met as group mates in their final year. The trio stayed in touch after graduation, meeting for ‘catch-up’ meals twice a year.

“The idea for Taxpedited emerged during one of those catch-up meals,” says Russell.

The foundation of Taxpedited

“I had stumbled across an instructional video demonstrating how basic machine learning (ML) algorithms could be written in Excel and asked Jeremy if it was feasible,” Russell elaborates.

After moving from the Big Four to a cryptocurrency payments startup, his interest in automation and technology grew.

With Jeremy’s programming expertise as data and systems manager in private equity firm Partners Group, he confirmed the theory, prompting Russell to build his first use case: classifying fixed assets according to their tax treatments.

Jon, having spent a decade at General Electric, including being the Commercial CFO for GE Aerospace APAC, then helped commercialise the concept. Through their industry contacts, the trio developed their first proof-of-concept to test the market.

However, the response was lukewarm. While their contacts found the idea interesting, they didn’t see the value of pursuing it solely for capital allowance classification.

That was until Russell was struck with a flash of inspiration: “I realised that if fixed asset tax classification could be automated, the same logic could be applied to automate income statement analysis. With both processes automated, theoretically, most tax computation preparation processes could also be automated.”

This led to the genesis of Taxpedited, with its focus on corporate tax compliance.

Jon explains, “Despite the availability of off-the-shelf tax preparation tools, the tax computation workflow remains largely labour-intensive and error-prone. Taxpedited’s tax computation engine is designed to save time, reduce errors, and revolutionise the way tax computations are prepared.”

Elaborating further, Jeremy discusses the principle behind their product, “Our flagship product, the Singapore Income Tax Computation Tool, is designed to prepare computations for trading companies and investment holding companies in minutes. Our tool proposes tax treatments using AI-powered analysis, complemented by convenient dropdown menus and a guided workflow.”

How Taxpedited’s product empowers accountants

While AI is transforming accounting, the Taxpedited team believes it won’t replace accountants. “These tools simplify and accelerate the repetitive and time-consuming tasks, such as data entry and formatting,” Russell emphasises.

“By automating these processes, accountants can focus on higher-level analysis, strategic advice, and delivering more value to clients. Taxpedited ensures that accountants can deliver more precise, timely, and impactful work, reinforcing the profession’s value rather than diminishing it.”

Challenges of building a startup

However, building their client base and convincing businesses of the efficacy of their product was no easy task. One major hurdle was identifying and reaching the right clients. The trio built their prospects from scratch, engaging directly with industry professionals to better understand their workflows, and refining how Taxpedited to meet their specific needs.

This included providing hands-on support to demonstrate how Taxpedited could deliver immediate value without disrupting established workflows.

How their shared SMU experience helped build a startup

Russell attributes their success to their shared experience at SMU, which helped build trust and a deep understanding of each other’s strengths and weaknesses.

“SMU’s industry partnerships also enabled us to gain hands-on experience at accounting firms, which guided us in designing software tailored for accounting professionals.”

Echoing his sentiment, Jon adds, “SMU’s emphasis on continuous learning, adaptability, and time management fostered a mindset crucial for our entrepreneurial journey.” As interest in their product grows, the team now faces the challenge of balancing their product roadmap with client requests for new features, ensuring the software evolved to meet the industry’s ever-changing needs.

Getting incubated at the SMU BIG programme

In January 2025, Taxpedited was successfully admitted into the SMU Business Innovations Generator (BIG) programme, run by the SMU Institute of Innovation & Entrepreneurship. The four-month coaching programme is designed to help early-stage startups validate their product and prepare for seed investment.

For Jeremy, the timing couldn’t be better. “Bringing AI solutions into the real world, requires continuous learning. The expert coaching and network from the BIG programme have been game-changers, helping us uncover blind spots, make informed decisions, and avoid pitfalls that could threaten our progress.”

Jon adds, “Seeing Taxpedited take shape has been incredibly rewarding, but we know this is just the beginning. We’re thrilled to be part of the SMU BIG programme, where we’ll gain invaluable insights from experienced entrepreneur mentors and industry experts.”

The entrepreneurial journey

The journey of Taxpedited’s co-founders demonstrates how accounting knowledge, combined with AI expertise, can open up new career opportunities and pathways for accounting graduates.

With the right skills and the courage to innovate, new roles are emerging for accounting professionals armed with both technical and financial know-how.

A final takeaway for students: Just as Russell, Jon, and Jeremy did, stay connected with your project team members after school projects. You never know—your next business partner might be closer than you think.

Ready to embark on a new chapter of your academic journey? Accept your offer now!