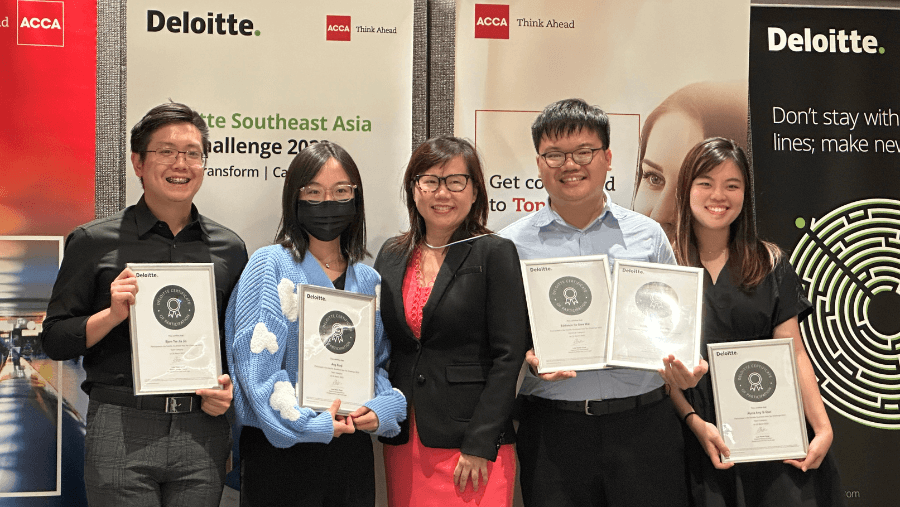

SMU Tax Champions Score Big at the Deloitte SEA Tax Challenge 2023

Four students from SMU School of Accountancy share their experiences participating in the Deloitte Southeast Asia Tax Challenge 2023 in Kuala Lumpur, Malaysia. Emerging first runner-up and second runner-up for the individual and group categories respectively, the team share how their thorough preparation and strong teamwork helped them put forth a formidable presentation. The competition has also helped them gain deep insights on taxation practices across the region.

As National Champions of the SMU Tax Competition 2022, our team represented Singapore on the international stage at the Deloitte Southeast Asia Tax Challenge 2023. The challenge was held in March in Kuala Lumpur, Malaysia and featured the champion teams of the respective national tax competitions across five nations: Indonesia, Malaysia, Philippines, Singapore, and Thailand.

Preparations for the Tax Challenge

As we were facing champions from different countries, our team anticipated the high intensity of the competition. Amidst our busy schedules, we developed a strategy through leveraging on the expertise of our assigned Deloitte Mentor assigned, Ms Swati G., International Tax Director Deloitte, and consultations with our faculty mentors Sum Yee Loong, Professor of Accounting (Practice) and Chan Wenjie, Adjunct Lecturer of Accounting.

Recognising the importance of time management during the actual event, we knew that ample preparation was one of the critical factors for us to succeed. We studied the latest developments in International Tax and kept abreast of updates revolving Base Erosion Profit Shifting (BEPS) Pillar Two. At the same time, we familiarised ourselves with notable regional tax changes in Southeast Asia and discussed ideas on emerging trends such as Taxation in the digital economy, the impact of ESG on taxes and Transfer Pricing Methods in Taxation.

Facing the competition head-on

On the day of the competition, participants took on the role of an in-house tax consultant to an assigned company. We had to develop a comprehensive tax restructuring plan to minimise tax exposure to the various jurisdictions the company was in. Each team had 90 minutes to analyse the case study and prepare for a 20-minute presentation for the team segment and 15 minutes for the individual segment, which was followed by a five-minute Q&A segment. This constituted 60% of the competition score. The remaining 40% of the competition was graded by preparing a memo to the Ministry of Finance on an assigned topic.

Our dynamic chemistry and unique skill sets helped us thrive at this competition. We understood each other’s strengths and weaknesses and were thus able to work together to develop innovative solutions efficiently. As a team, we developed solutions designed to help the company minimise its tax exposure and recommended solutions to circumvent Permanent Establishment Issues in the Pre and Post BEPS Era. The combination of thorough preparation and strong teamwork helped us put forth a formidable presentation that the judges received positively.

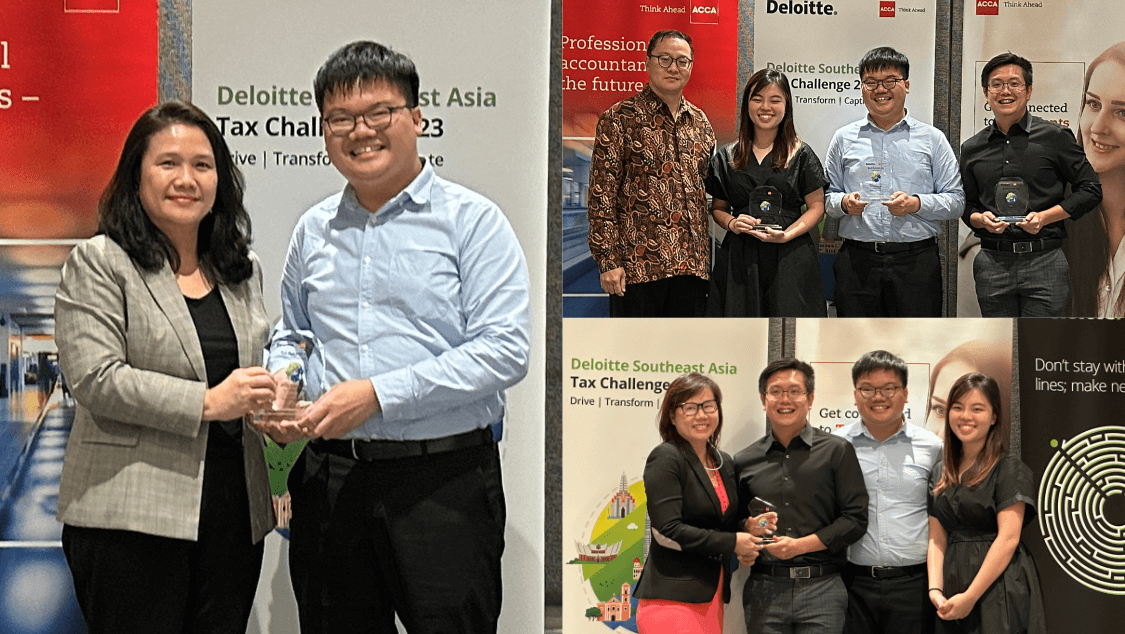

(Left) Eddieson, 1st Runner Up, Individual Segment

(Top Right) 2nd Runner Up, Team Category

(Bottom Right) Best Writer, Team Category

Our efforts came to fruition when it was announced that we had emerged as the 2nd Runner-up and the Best Writer Award for the team segment, as well as 1st Runner-up for the Individual segment of the competition.

An unforgettable journey for the team

We would like to thank all the judges from Deloitte for taking the time to listen to our tax proposals, provide valuable feedback and adjudicate the case competition.

We are also immensely grateful to Deloitte for sponsoring this competition. This competition has helped us gain deeper insights into taxation practices across the region and, at the same time, allowed us to apply the analytical and research skills that we have gathered throughout our journey in SMU to solve real-life tax issues. We are also humbled to be able to learn from our counterparts from different regions and universities. As a group of year three and final-year students, this experience proved to be an incredible finale to our university journey together.

Find out more about joining SMU here.